Crypto, Web3 and The Global Unleashing

The rise of the bottom up, and surprising lessons and leadership from Africa and other rising markets

Today I had, as I often do, a long call with a brilliant mind, and this time it was one of our partners, Falgu Shah. She has keen insight into fintech and a lens from abroad on many issues of our times. We spoke a great deal about crypto in emerging markets and Web3 more broadly.

At one point she said something parenthetically but profound:

“These are simply different worlds.”

She didn’t mean only what is always true in innovation – that it is the new generation who envision things not there before and disruption comes from the outside in. She was noting that we are in the process of a re-ordering of basic principles not only of the economy and business, but who is responsible for the ordering of society.

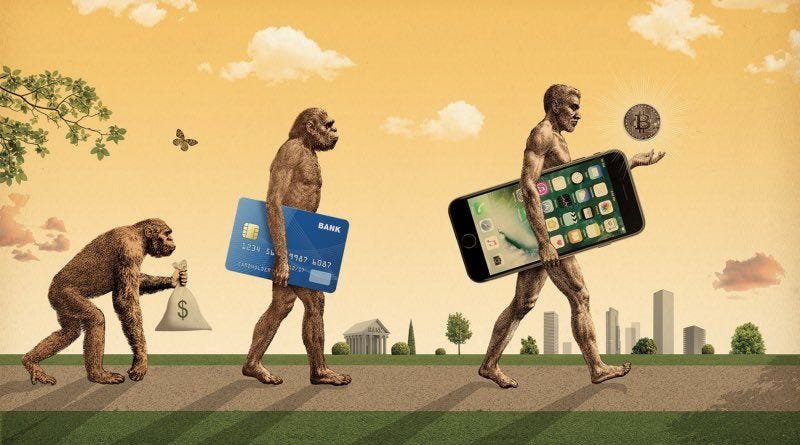

Grey hair that I am, she asked me how today seemed different from Web1 or Web2. My initial reaction is that today is not about moving business as we knew it to new capabilities – moving ads online and then to mobile; moving commerce; moving music and writing. Those have been assuredly and massively disruptive in so many ways.

Today, however, is structural. It is about new choices of how our communities, societies and countries work. It is about the “bottom up” having increasing control in problem solving and economic rules of engagement seeming forever in the hands of the “top down.”

One of my favorite social entrepreneurs who now runs the Legatum Center for Development Entrepreneurship at MIT is Dina Sherif. She made a distinction for me years ago in the heart of Web2 where we saw early signs of today’s change. She noted that the differences between “top down institutions” (governments, big NGOS, big business) and “bottom up” unleashing of innovation offered by entrepreneurs are attitudinal.

“Top down institutions in the end,” she told me, “view people as problems to be solved. We here in our big capital and bureaucracies will solve you poor people’s problems. But a bottom up mind set looks at people as assets to be unleashed. Here problems are solved by people with the talent and greatest interest in solving what they understand best and often in their own backyards.”

We are in an era of a great unleashing.

So many conversations I have about crypto and Web3 focuses on the technology, and the FOMO of who is making something or some money faster than someone else. All periods of revolution have some version of this. The wonderful quote, wrongly attributed to Arthur C Clarke, rightly sums up the history of innovation perfectly: “Revolutions are most often over estimated in the short run, and underestimated in the long.”

But revolutionary periods while often driven by new generations and enabled by newest technology, actually boil down to basic human behavioral needs.

So here are two basic questions in the context of crypto:

1) If top down institutions which have been created to better society, the economy, education, crime, health, freedom of expression and more not only don’t deliver the goods, but seem less and less relevant and even a rigged game – at what point do people, at scale, say “we need something else?”

2) More tactically if I can move value and “money” more safely, more securely, without friction and at a fraction of the cost of even the most recent disrupters, why wouldn’t I?

I think the answer to both questions explains much if not all about what is happening today.

For the first time hundreds of millions have access to supercomputing in their smart devices. They see the way the world is changing; they connect with each other without precedence; they are dissatisfied by business as usual and can fix it or can leap frog to the best capabilities available. Web2 meant social media, ecommerce, last mile logistic delivery, early days of financial inclusion and more. Web3 means the next level of all that and something broader. And all the early signs are in crypto adoption.

Falgu has particular expertise in Africa, but what she described to me there is happening in every rising market:

1) Crypto is no longer a story of the richest people moving money from unpredictable governments there, but rather a completely "democratized" moving of value bottom up. The majority of use cases are now peer to peer. People forget how deep and large the gray economy is across the continent and people are absolutely buying and selling goods with it. Many informal sellers on Whatsapp or Instagram accept crypto as payment. Cross border remittances is the fastest uptake she is seeing, mostly to and from Europe.

2) Local remittance companies are leaning in here, building on infrastructure like Stellar and Celo, the latter having recently opened operations in Africa and Latin America.

3) The drive is generational and by people regularly burned by devaluation and absurd fees, even while the recent fintech “disrupters” boast they are cheaper than legacy institutions like Western Union. It is, thus, also disrupting the disrupters.

4) There is a real uptick in young people asking to be paid their salaries in stable coin and some companies, especially startups, are beginning to oblige.

5) More and more startups are building services to institutionalize and embed crypto where the economics allow them to not only charge less but offer much higher deposit rates than anything possible in the traditional system today. (As an aside, one of the top global VC’s told me that in the last year one third of ALL pitches he sees now include some element of crypto or Web3 services pre series A).

6) Even where governments are “blocking” crypto, there are many workarounds – people can load wallets they’ve created in the US or UK or elsewhere, or have families do so, and then remit the value on the chain. In effect it really isn’t that blockable and more and more governments who want to see greater problem solving are trying to figure, instead, out how to engage.

She concluded:

"People have to understand this is simply another world. Traditional VCs who are in are seeing it; large financial institutions like Visa are making big bets here - but most of the activity is happening in other often virtual worlds, other and often virtual communities and generational. They are also able to fund themselves and incentivize their communities to participate. It amazed me how up until recently many fintech pitches we see from smart local/regional entrepreneurs still did not have crypto as a part of their business plans. But then it amazes me how quickly that has changed in only the last few months."

Maybe the Web2 Juggernauts – all of whom are stepping in here aggressively and already have mass consumer reach – will dominate what is coming. But I’m not so sure, especially in rising global markets.

New juggernauts are created in these kinds of massive changes in human outlook, need and behaviors. And in their desire – and capabilities – to have agency; to have ability to solve problems and make their lives better bottom up

What about the environmental impact of crypto mining? Isn’t it unsustainable?